Our Capabilities

Value-Added Investments

With one of the best, most experienced and cohesive investment teams in the REIT sector, Ventas is the premier capital partner to leading care providers, developers, research and medical institutions, innovators and other healthcare providers, with a well-earned reputation for using creativity and insight to execute deals others cannot.

External growth is one of our core competencies. We've delivered more than $39 billion of strategic investments in the past 20 years through a best-in-class investment culture, rigor and process, built on our dedicated team’s deep industry knowledge and diverse expertise across the critical areas of underwriting, finance and investment, banking, development and operations.

Global Institutional Investment Management

Ventas Investment Management (VIM) enables the Company to access an expansive market opportunity by attracting global private capital to our demographically driven asset classes. VIM capitalizes on Ventas’s position as a trusted industry expert and innovator with a proven track record of success through market cycles. Private owners of real estate seek to invest alongside Ventas directly in research, senior housing and other healthcare real estate to obtain the benefit of our experience, relationships and industry knowledge.

Partnerships with Industry Leaders Provide Proprietary Growth

Ventas aligns with superior operators and developers to invest in their long-term growth alongside our own. We have a proven track record of investing in and promoting long-term and growing relationships with partners across our portfolio who bring scale, skill and access to growth opportunities.

Proven Investment Approach

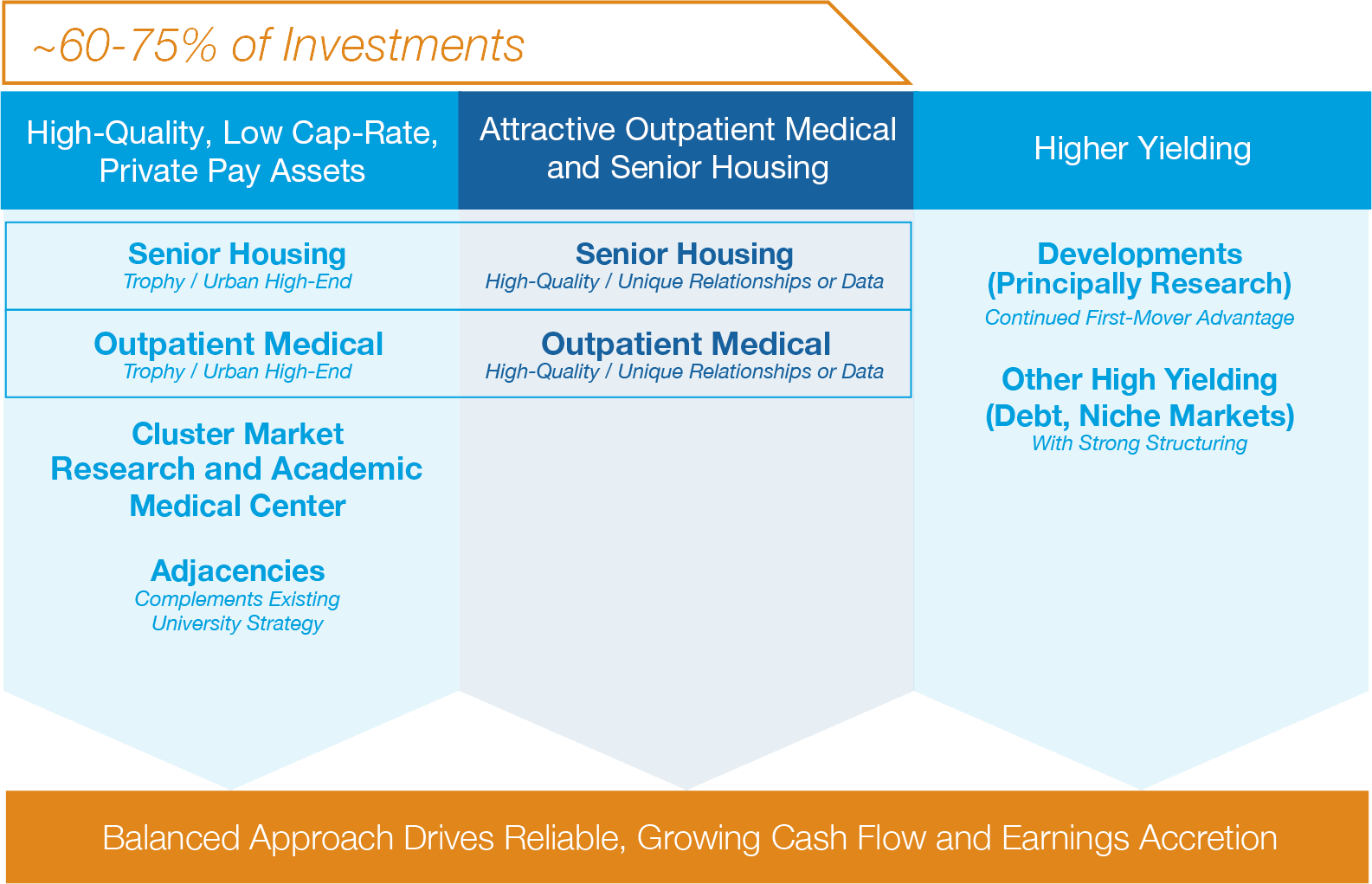

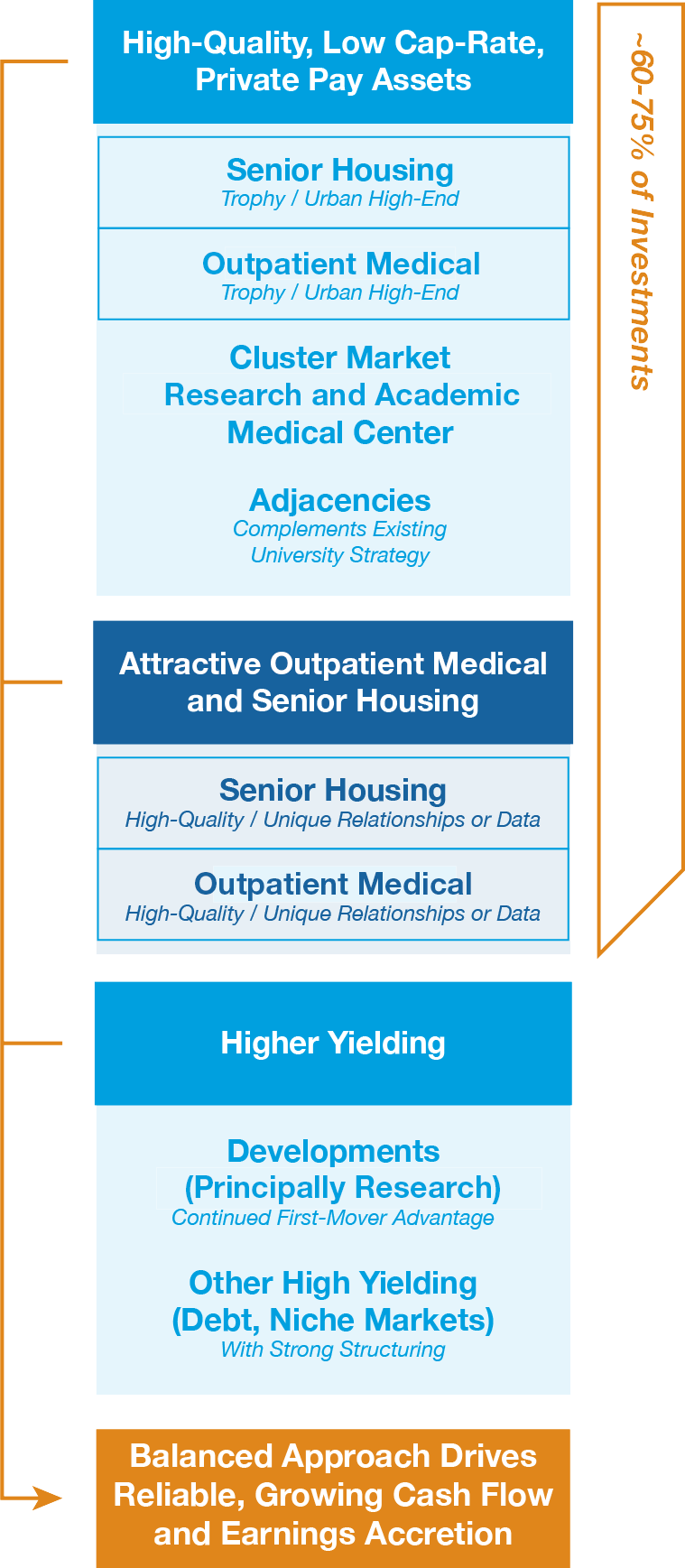

As a disciplined investor, Ventas has a clear set of capital allocation priorities and looks for accretive investments in advantaged properties that will complement our diversified portfolio. We evaluate each opportunity across a wide variety of risk-adjusted measures and invest in high-performing assets and partners who can deliver strong cash flows year after year.

Ventas maintains a balanced investment strategy that has produced significant cash flow, accretion and value creation:

Commitment to Sustainable Business Practices

Ventas is an industry leader in environmentally and socially responsible practices across every aspect of our business.

Responsible Growth

Reflecting our commitment to long-term outperformance, ESG due diligence is an integral element within all our acquisitions, dispositions, development and redevelopment and operator and partner selection processes.

Operational Excellence

Our Corporate ESG & Sustainability team collaborates with operating partners, tenants and leading vendors and technology providers to identify and implement emissions, water, energy and waste efficiency measures across our portfolio.